Data collection is an integral part of life and business at financial institutions. For customer contact, internal processes, payment collection, and everything in between, financial services professionals rely on the ability to collect and use real-time data.

As a secure data collection platform, FormAssembly solves data collection challenges and provides an invaluable return on investment. The ability to collect and leverage data is particularly crucial as financial services organizations undergo digital transformation and come up to speed with modern software solutions.

In this post, we’ll explore six impactful ways to use FormAssembly in financial services, based on real-world examples from actual customers. You’ll discover how your financial services team can apply these ideas in order to generate positive change for your entire organization.

Solve common financial services pain points

The data collection conversation is relevant to almost every industry, but there are several ways that FormAssembly targets specific pain points within financial services.

Banks, advisory firms, mortgage companies, and consulting agencies encounter similar issues when it comes to adapting technology to an ever-changing data landscape. Many financial services customers turn to FormAssembly because they’re facing one or more of these problems:

- Outdated paper form processes used for customer and business contact

- Manual processes that slow down efficiency and keep organizations behind faster-moving competitors

- Limited tech or IT staff to create, manage, and implement new data processes

- Weak or missing integrations to other important business apps and systems

- Inability to process sensitive financial data and protected consumer information

Discover powerful finserv data collection solutions

With FormAssembly’s easy-to-use web form and data collection platform, financial services professionals can start making huge changes in a relatively short amount of time. Additionally, with each use case you implement, you can rest assured that your new data processes are backed by industry-leading security and compliance standards, including GLBA and PCI DSS Level 1.

Take a peek at six of our most popular use cases for financial services organizations to see how FormAssembly can help your team adapt to any need.

1. Customer and client onboarding forms

When you onboard a new client or customer, it’s crucial to learn as much as you can about them in order to provide the best service. Staff members who oversee the onboarding process can save substantial time and effort by eliminating traditional methods of manual data entry and onboarding paperwork.

With FormAssembly, your team can quickly make updates to customer accounts, collect documents through the use of attachments, and integrate data seamlessly to a CRM solution like Salesforce.

This use case is especially helpful for smaller consulting firms that may not have as many staff members or hours available to devote to manual processes. FormAssembly helps growing financial firms like HFM Investment Advisors automate the onboarding process and free up more time for nurturing actual customer relationships.

2. Account application forms

In regards to automation, many financial institutions need secure and reliable ways to collect online applications for new accounts, which may be personal or commercial.

With the flexibility of FormAssembly, organizations can publish application forms publicly (typically hosted on a primary website) or behind a secure login. The account application use case applies to any customer or business looking to open checking, savings, and other types of financial accounts.

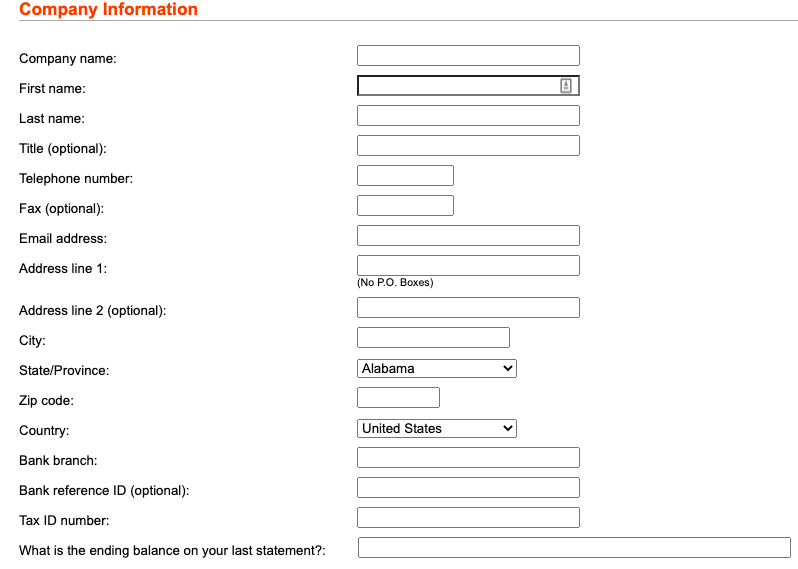

Application forms also provide flexibility for account managers who want to see the status of an application at any stage in the approval process. For instance, the Client Services Group at Cadence Bank employs this exact method to process new applications with greater speed and accuracy. Below, you’ll see an example of a commercial account application from Byline Bank, another FormAssembly financial services customer.

3. Franchise management forms

Many financial institutions are set up to accommodate branches, franchise locations, and independent consultants. As a result of these operations, the parent company should have a streamlined method for managing incoming data from separate locations.

FormAssembly forms create a simplified path for maintaining contact, updating records, and having administrative oversight. Additionally, secure web forms can be used to onboard new branches or consultants, collect certification information, and manage workflow processes with ease.

4. Internal administrative processes

Internal efficiency is vital for growing financial services firms. Cross-departmental collaboration is critical, and time-saving processes can make all the difference in daily operations. With FormAssembly, you can make several internal changes right out of the gate, including:

- Replace outdated paper forms to save time and money

- Overhaul manual data entry to free up staff time

- Create user-friendly forms for any internal purpose

- Immediately update customer relationship management systems with real-time data

5. Personal and commercial loan application forms

FormAssembly offers a flexible solution for collecting the data required to secure personal and commercial loans. Loan application and intake forms can be created using conditional questions and fields that accommodate changing regulatory requirements.

In times of rapid change, like during the COVID-19 pandemic for example, the ability to duplicate, edit, and send forms quickly is highly beneficial. Financial institutions can continually receive and send loan data without service interruptions.

The result? More loan customers, better user experience, and more reliable data.

6. Marketing and lead routing forms

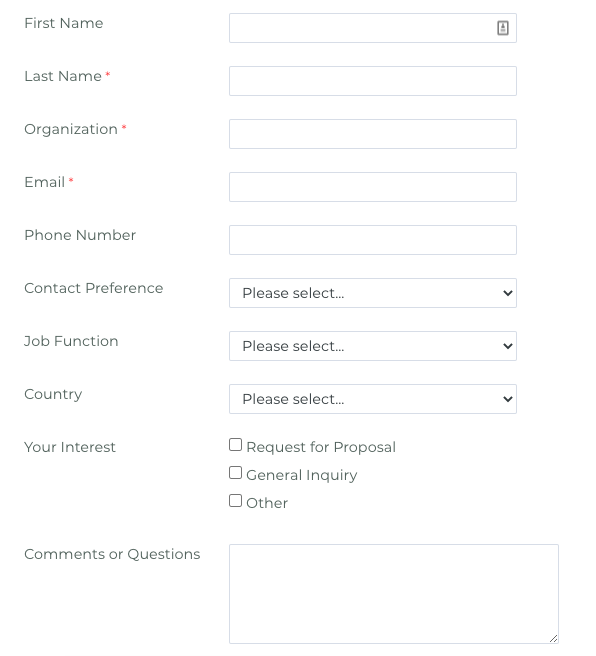

When acquiring new financial services customers, lead routing is an important step. FormAssembly provides a seamless way to create and publish customizable lead capture forms directly to a website or specific landing page. These forms can be as simple or complex as you need them to be.

Use lead capture forms to gather data about an individual’s contact information, industry, and employment data. Then, upload that data directly using FormAssembly’s Salesforce integration or the Salesforce Marketing Cloud connector. This data is then visible to sales team members and other outreach specialists who are better equipped to sell services to new customers.

Transform your financial services organization

Improved data processes create a positive change throughout an entire organization, benefiting everything from your business model to your customer relationships. Learn more about the reasons to use FormAssembly for financial services in our helpful 10 Reasons to Use FormAssembly infographic .