For financial services organizations, collecting accurate client data isn’t just about efficiency – it’s a matter of compliance, security, and client trust.

From onboarding new clients to capturing leads and managing applications, having a streamlined, secure data collection process is critical.

Yet, many firms struggle with outdated forms, disconnected systems, and regulatory requirements that complicate even simple data collection tasks.

The good news: FormAssembly Atlas can help your team overcome these challenges and work smarter, faster, and more securely. At the center of the platform is Fai, an agentic AI assistant that is able to instantly generate branded forms and workflows, complete with seamless Salesforce integrations.

We’re always listening and always trying to find ways to improve data collection for our users. Here are seven of the biggest data collection challenges we know that financial services firms face and how Atlas and Fai help overcome them.

Challenge #1: Outdated or unreliable web forms

Many financial services firms rely on legacy web-to-lead forms that are clunky, prone to crashes, or not mobile-friendly. Features like reCAPTCHA can sometimes break the submission process, creating frustration for both clients and staff.

FormAssembly’s Solution: FormAssembly provides modern, responsive forms that integrate directly with Salesforce and other CRMs. You can set up multi-step, progressive forms with hidden fields, UTM tracking, and prefilled client information, all while maintaining security and compliance standards like GLBA, and while using Fai to help you do it.

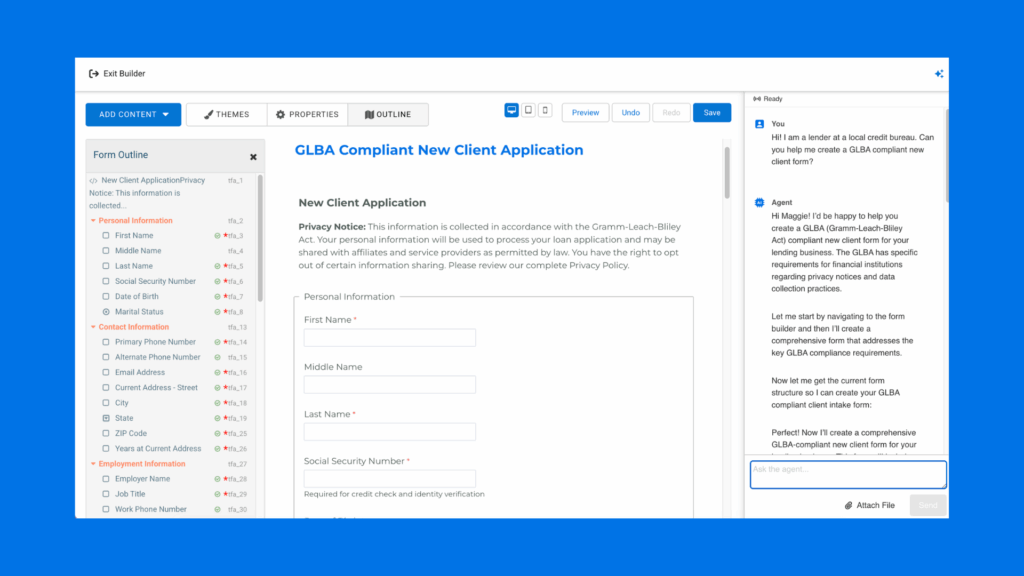

Challenge #2: Managing compliance and regulatory requirements

Financial services firms face strict regulations around data privacy, storage, and communication practices. Collecting client information without meeting these requirements can create legal and reputational risks.

FormAssembly’s Solution: FormAssembly is SOC2 certified, GLBA compliant, and can meet data residency requirements in the US or Canada. Additionally, users can prompt Fai to create forms and workflows that securely collect sensitive information, manage e-signatures, and integrate with platforms like Plaid for verification, ensuring you stay compliant at every step.

Challenge #3: Integrating data across systems

Client data is often scattered across Salesforce, Wealthbox, Zoho, or other CRMs. Without seamless integration, teams spend hours manually importing or reconciling information, risking errors and inefficiencies.

FormAssembly’s Solution: FormAssembly integrates with Salesforce, Wealthbox, Zoho, and other systems. It supports prefilled forms, bidirectional data syncing, and dynamic picklists, enabling data collected via forms to flow directly into your CRM.

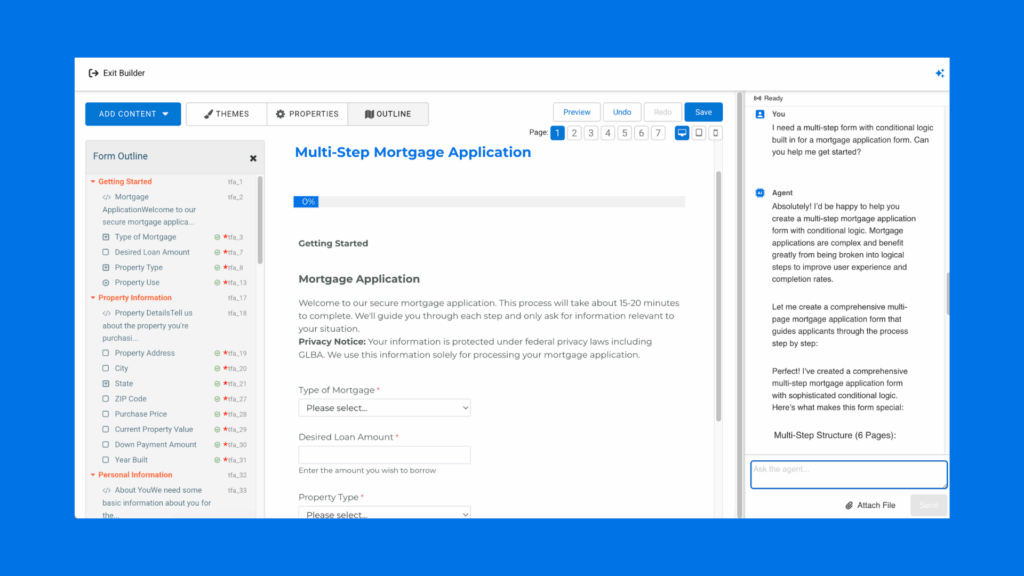

Challenge #4: Collecting complex client information

Financial advisors and planners need detailed data for fact finders, contracts, questionnaires, and financial assessments. Manually handling these forms is time-consuming and error-prone.

FormAssembly’s Solution: Fai can easily create multi-step forms with conditional logic to guide clients through complex data collection processes. Documents can be uploaded securely, prefilled fields can be implemented to reduce manual entry, and workflows can route submissions to the right team members automatically.

Challenge #5: Providing a secure and client-friendly experience

Clients expect an easy, secure way to submit sensitive financial information. Clunky forms or poor authentication processes can lead to frustration or abandoned submissions.

FormAssembly’s Solution: Forms can be white-labeled, mobile-friendly, and customized to match your brand. Clients can securely access forms through links with email or text authentication, drag-and-drop document uploads, and intuitive interfaces, all while keeping data secure.

Challenge #6: Tracking lead sources and optimizing marketing efforts

Understanding how clients found your firm and which campaigns are effective is key for growth. Traditional forms often lack tracking capabilities or robust analytics.

FormAssembly’s Solution: FormAssembly automatically captures UTM parameters, tracks conversion rates, and provides analytics on form performance. You can match submissions to existing records, monitor sources of traffic, and refine campaigns based on real-time insights.

Challenge #7: Automating workflows and approvals

From credit applications to multi-approver client onboarding, financial services firms need to move data through several stages quickly and accurately. Manual routing can create bottlenecks and errors.

FormAssembly’s Solution: Fai can create workflows that enable multi-step approvals, automated routing, and conditional steps, in addition to creating forms that are able to prefill Salesforce data, generate documents, and provide updates to stakeholders. With Fai on your side, you can easily streamline processes and reduce turnaround times for your clients.

Creating a More Efficient Data Foundation

Accurate, compliant, and efficient data collection is essential for financial services firms to serve clients, maintain trust, and stay ahead of regulations. FormAssembly helps firms simplify processes, integrate systems, and automate workflows so your team can focus on building client relationships, not chasing data.

Learn more about how FormAssembly supports financial services firms.

Interested in exploring Atlas? Book a personalized demo or start a free trial today.